Media / Investor Relations

Hess Group International Address:

J/F Kennedy Street 6 3106 Limassol, Cyprus

[email protected]

In layman terms, private equity is equity – meaning, that the shares represent ownership or interest in an entity which is not listed publicly. A big part of the private equity industry consists of institutional investors such as pension funds and large private equity firms such as Hess Group International (HGI) funded by a group of accredited investors. Sources of investment capital usually derive from individuals with a high net worth and companies that purchase shares of private firms. Companies can also take control over public companies, privatizing and eventually delisting them from the public stock exchanges.

Large capital is required in order to gain a significant influence on a company’s operations, which is why people with large funds will dominate the industry. The amount of capital required depends on the firm and the fund. Some funds may have a $100,000 minimum investment requirement but others may require millions of dollars.

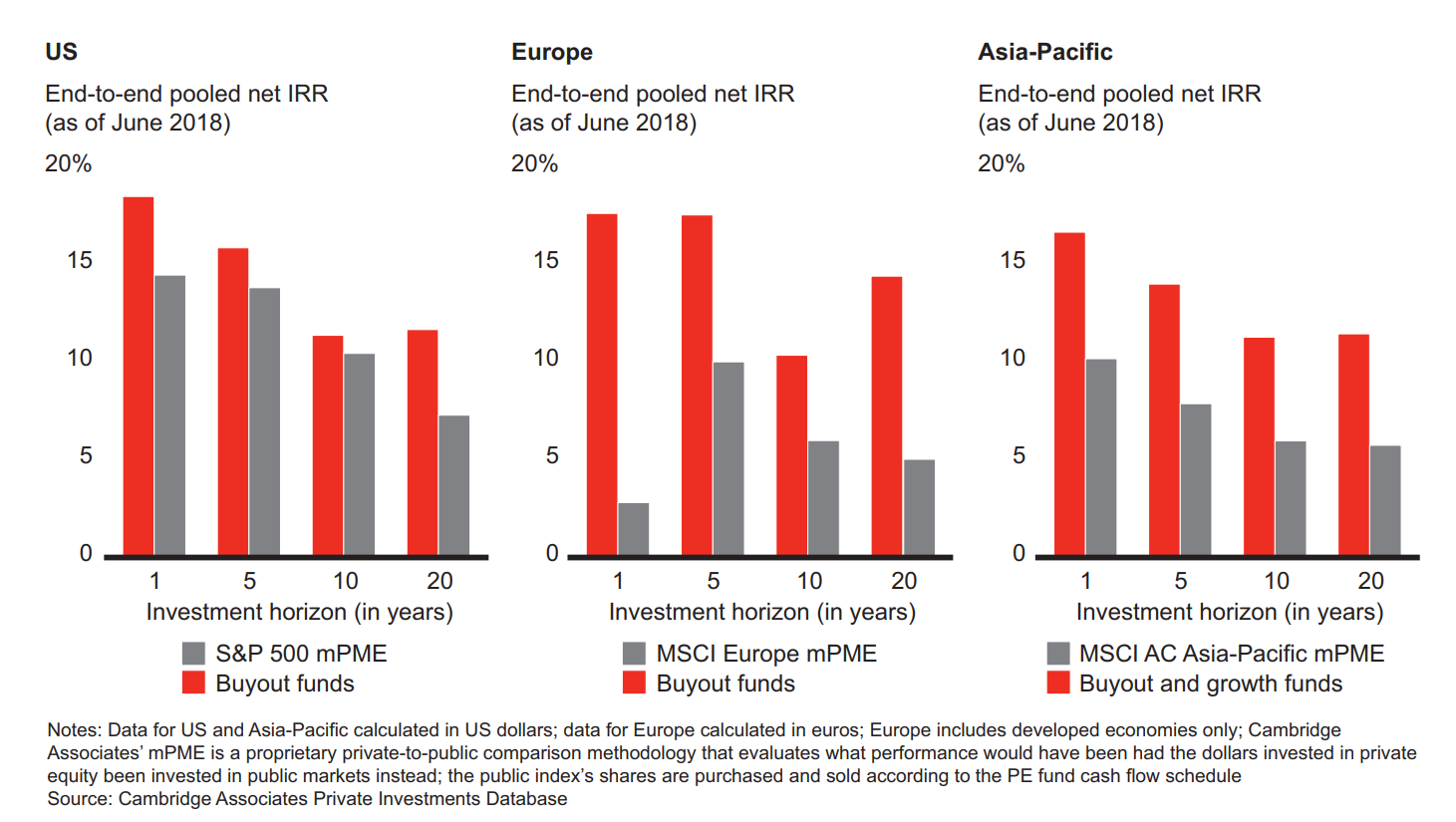

Is there a motivation for such investments from individuals and firms? You bet. The main motivation is achieving a positive return on investment. In private equity firms’ partners raise funds and manage them to yield favourable returns for their clients. A testament to this is the fact that in 2018 buyout funds outperformed public markets in all major regions.

Buyout funds vs. public markets, source: Bain Private Equity Report 2018.

Over the years, private equity has attracted very influential companies in America, which include leading companies from Fortune 500 and top-notch strategy and management consulting firms.

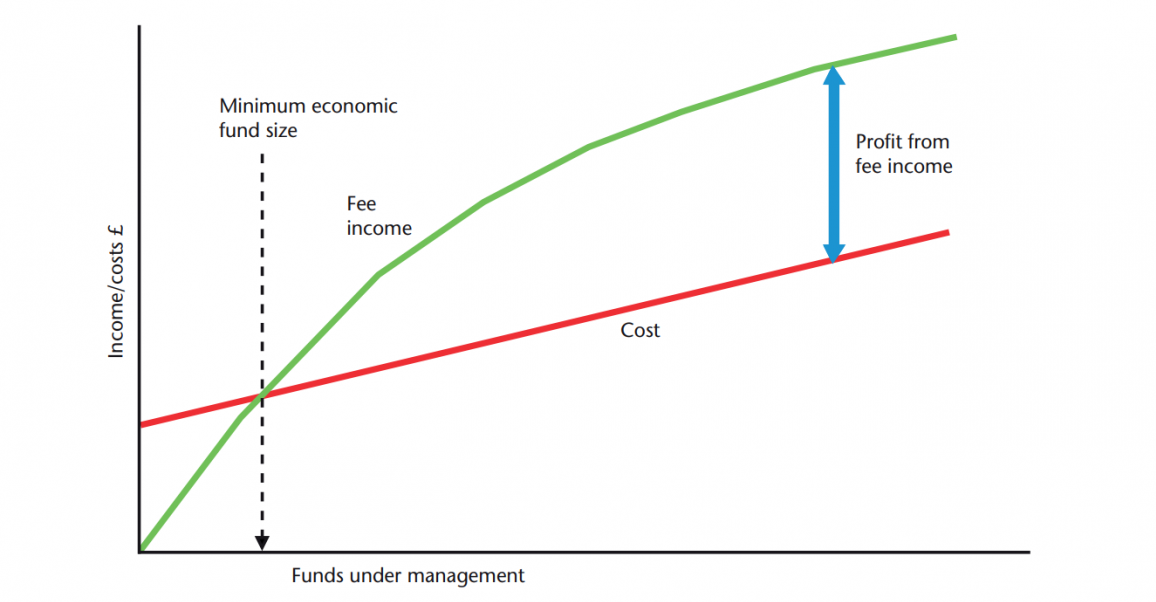

Fee structures vary in private equity companies, but they usually consist of a management fee, which is expressed as a percentage of the funds raised, in other words, all of the profits that the fund has made past all operational expenses as expressed in the graph below.

The relationship between costs and income, source: Preqin.

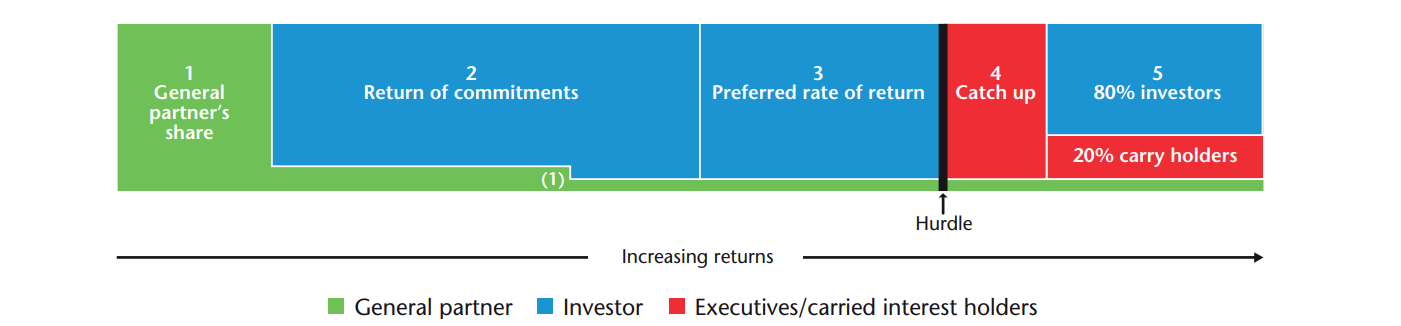

In addition to management fees, there is carried interest (or carry) – the share in the profits of the fund. This occurs once the investors reach their target returns (hurdle), historically 8% per annum. The result, the fund managers share in the excess profits. These funds are usually referred to as ‘two-twenty’ funds because 2% fee and 20% carry. This appears to stem from medieval Venetian trading contracts between ship owners and merchants.

The mechanics of carried interest, source: BDO (UK) LLP.

Private equity is established as a limited partnership by a general partner or a fund manager, which sets out the rules and regulations for the fund. The general partner contributes from 1% – 3% of the total investment. Where does the remaining investment come from? Universities, pension funds and other institutional organizations. Wealthy families may also contribute to cover the remaining investment.

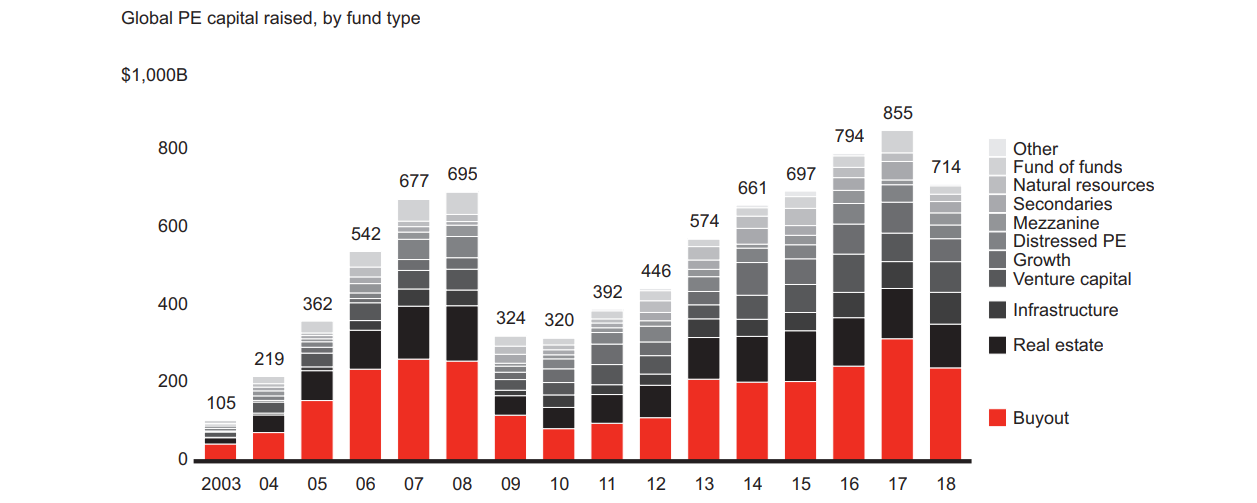

Global Private Equity capital raised, by fund type, source: Bain Private Equity Report 2018.

Each contributor is a limited partner in the fund, so this makes the liability proportional to the contributed capital. An agreed commitment is made between the limited partners and the General Partner (GP) for a specified amount of time, which is known as an investment period. Once the company is sold to a financial buyer or to another investor or gone public on IPO – the fund distributes are allotted back to the limited partners.

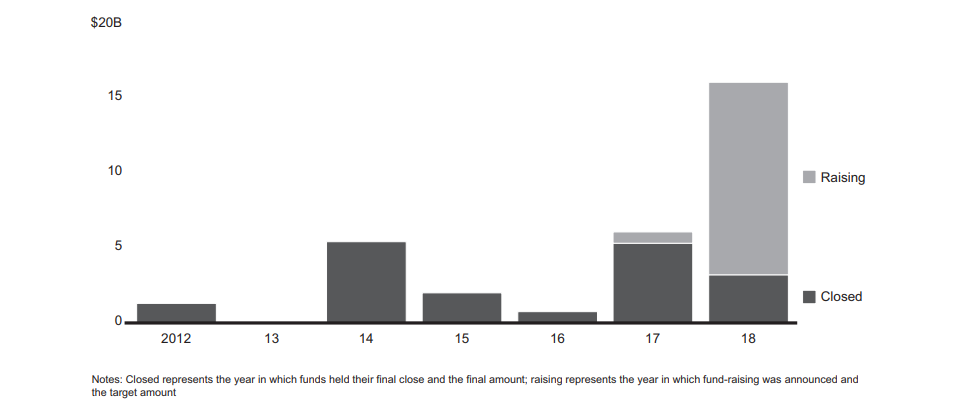

In the last few years, a new trend has emerged – funds targeting GP equity stakes have increased. The emergence of bulk buyers like Dyal Capital Partners and Blackstone Strategic Capital Holdings has accelerated the trend. A Coller Capital survey in 2018 has indicated that one in six LPs invested funds pursuing GP stakes, while another one in five considered such investments.

Global Private Equity fund-raising targeting GP stakes, source: Bain Private Equity Report 2018.

The private equity industry has spread around the globe to Europe and other markets from the 1970s. The globalization of PE firms is forecasted to grow in the near future. The work done by private equity firms contributes greatly to the global economy. Private equity firms such as Hess Group International understand what it takes to make a company successful. It is by means of leveraged buyouts and management of debt instruments, based on strict investment criteria that create a safe environment of growth.

For more information, please visit our social media channel – @hessgroupinternational

Contacts

For more information, please contact

Media / Investor Relations

Hess Group International

Address: J/F Kennedy Street 6

3106 Limassol, Cyprus

[email protected]