Media / Investor Relations

Hess Group International Address:

J/F Kennedy Street 6 3106 Limassol, Cyprus

[email protected]

There are several factors which must be considered by a PE (private equity) investor in order to make a sound investment which is appropriate for the PE firm. It all comes down to research which is needed to understand a company’s financials, market position, industry trends, and debt financing available. While there are many things to take into account in this specific article, we will cover the typical characteristics a good leveraged buyout (LBO) candidate must have.

- Stable and recurring cash flows

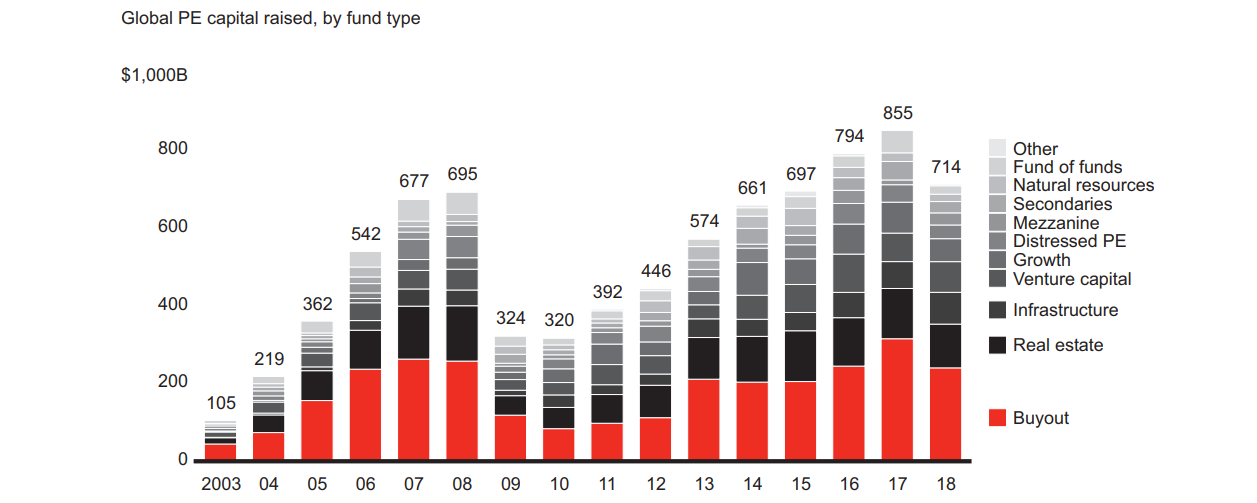

It is critical for a PE firm to be sure that a potential LBO has a stable and recurring cash flow to cover all the debt requirements. This also means having relatively low exposure to seasonal fluctuations in cash flows. Following the 2007-08 crisis banks significantly reduced exposure to leveraged buyouts, meanwhile, new forms of lenders emerged to fill the gap, which created new opportunities of growth for stagnant companies.

Global Private Equity capital raised, by fund type, source: Bain Private Equity Report 2018.

- Favorable industry trends

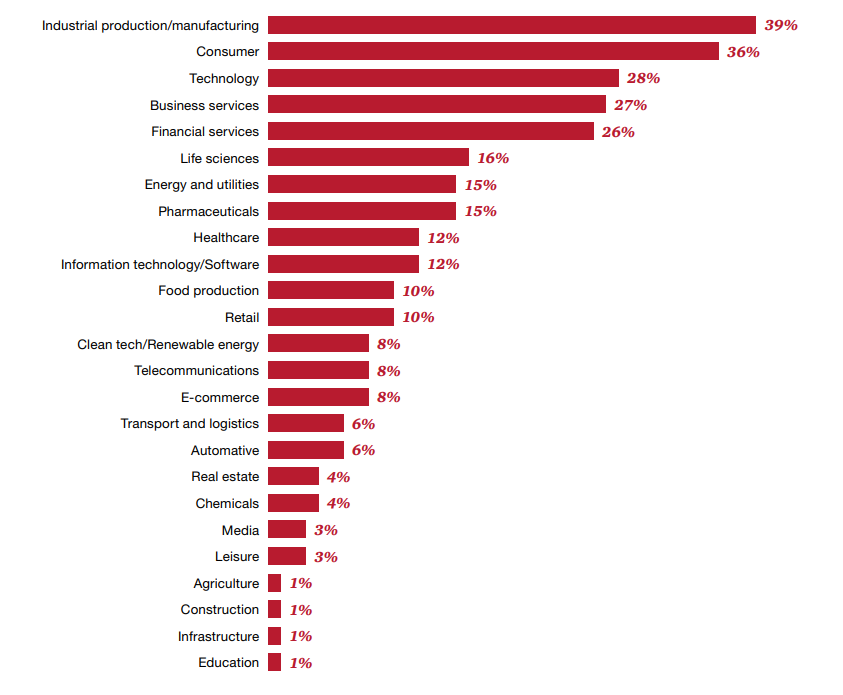

Trends can be identified within two types of analysis, industry – which attempts to interpret the overall relevance of the industry to the needs of its market, and market analysis – which examines the demand in relation to prices and product offerings, using consumer demographics and buying habits. These trends include, but are not limited to innovation, automation, adoption of new technology, digitalization, standardization, supply and demand, consumer preferences and perception, the list goes on. PE firms always search for companies that are well positioned within a trending industry. This results in market growth, which in turn provides a stronger equity return potential and pose less of a risk for the investors. The example below is taken from PWC’s Private Equity Trend Report of 2019, it portrays the opinion of industry leaders when asked in which industries would they consider investing (as GPs) over the next two to three years.

Industries firms are most likely to invest in over the next 3 years, source: PWC PE Trend Report 2019

- Strong market position

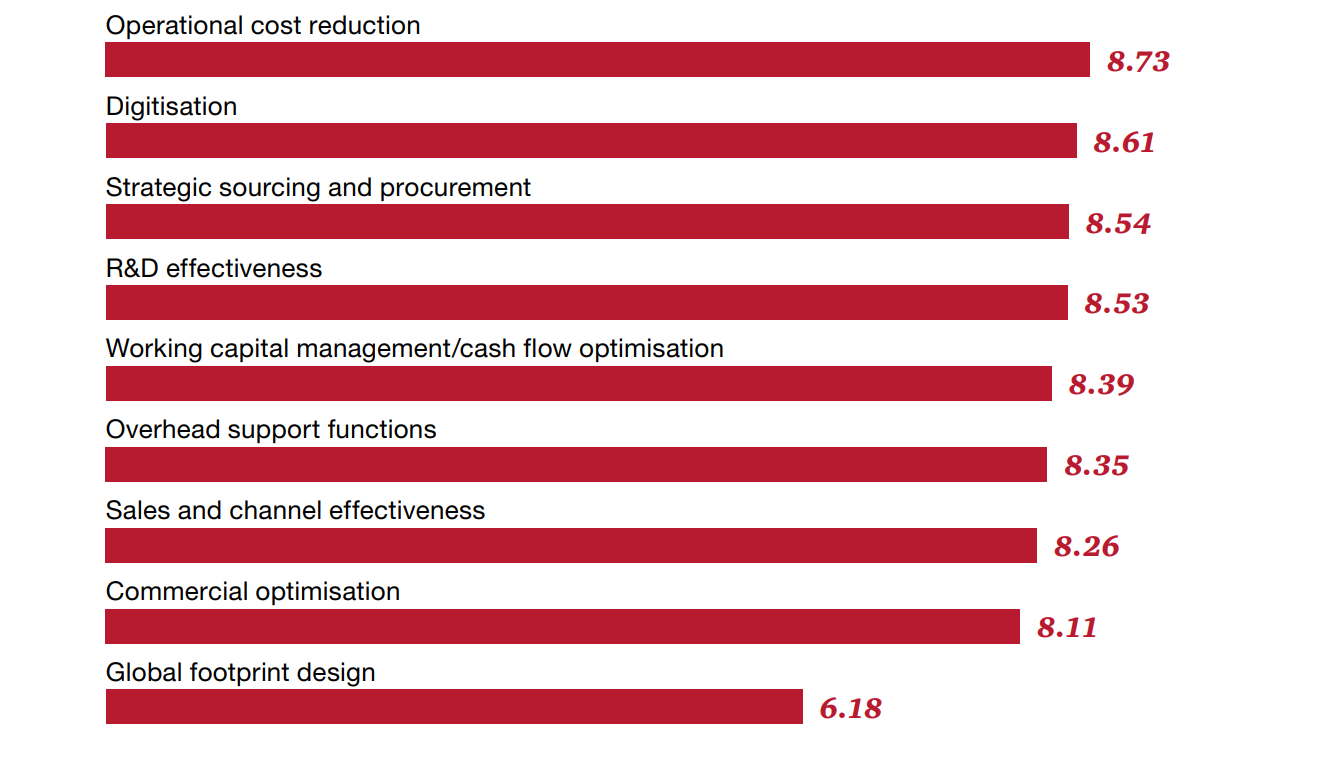

It is an obvious criterion but must be mentioned. Good LBO candidates include companies that are market leaders with sustainable business models. High entry barriers, high switching costs, and strong customer relationships are signs that a potential LBO has a strong market position and a sustainable competitive advantage. In PWC’s report industry leaders were asked to rate which factors are most important to value creation within equity investment, the graph below represents their answers on a scale of 1 to 10, from least, to most important. It is therefore safe to say, that a strong market position encompasses a number of these undermentioned factors.

Most important factors to value creation in equity investment, source: PWC PE Trend Report 2019

- Several avenues of growth

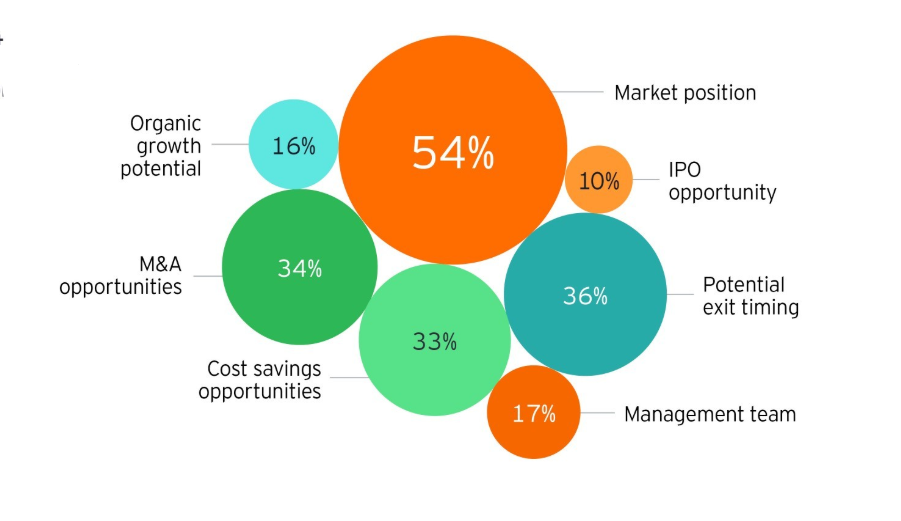

A growth strategy, which is diverse and balanced, is always helpful. This ensures that the success of a company is not completely reliant on one product. A way to achieve this could be through the introduction of new products, increase in the number of locations, acquisition of new customers, re-packaging and upselling of existing products or diversification, among many others. According to EY Global Private Equity Divestment Study the most important considerations when making an acquisition was market position and potential exit timing, full visualization below.

Most important factors when making an acquisition, source: EY, Global PE Divestment Study

- Strong management team

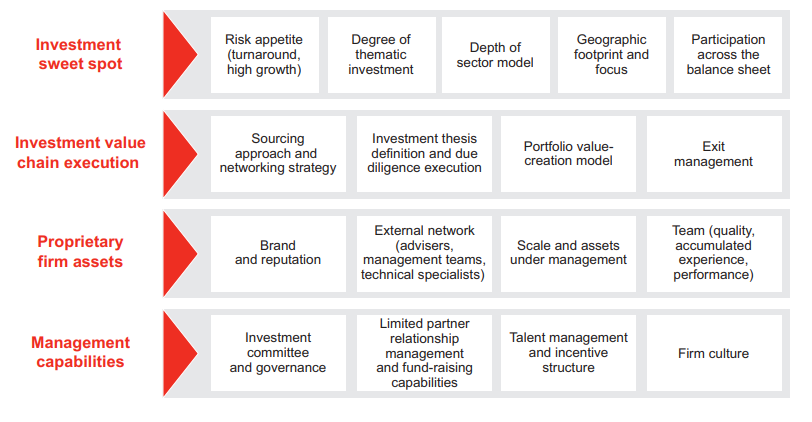

A good management team is essential for the success of a company. One might think, why would this be important since the PE firm will somewhat manage the company. The truth is that the private equity firm gives guidance but relies exclusively on the management team to execute their operating strategy. Without a strong management team within a company, the PE firm must have a replacement ready before seriously contemplating the investment. Funds that leverage their strengths in a disciplined, structured way stand the best chance of reaping profits from expansion.

Assets, expertise and capabilities PE funds can leverage, source: Bain Private Equity Report 2018.

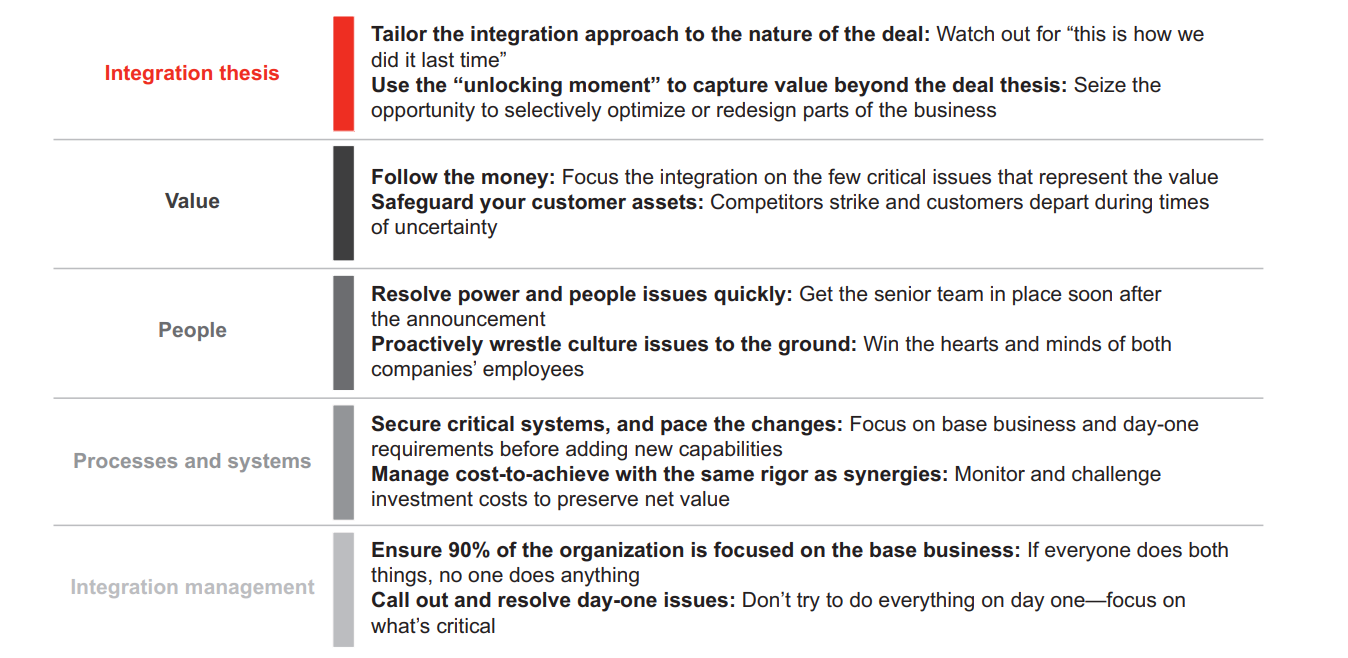

- Low capital expenditure requirements

Companies which require low capital expenditure provide the PE firm with more flexibility in terms of allocating the firms capital and running its operations. Businesses which require high capital expenditure will typically generate lower valuations from private equity firms since there is less capital available and there is an increase in financial risk. Such investments would require strategic execution, for instance, in a bid to trim capital expenditures Graham Packaging and Liquid Container merged and made it possible to cut back on procured molds, and thus spare machinery parts. Successful mergers follow a methodical path from integration thesis to integration management.

Merger path, from integration thesis to management, source: Bain Private Equity Report 2018.

In summary, PE firms like Hess Group International, make a critical evaluation of a potential LBO before approaching with investment deals. This is the most basic criteria to which every PE firm pays attention.

Another critical part of the investment process is due diligence. You can think of it as an investigation of a potential LBO. You can find out more about due diligence here.

For more information, please visit our social media channel – @hessgroupinternational

Contacts

For more information, please contact

Media / Investor Relations

Hess Group International

Address: J/F Kennedy Street 6

3106 Limassol, Cyprus

[email protected]